Any refund of tax may be offset against other unpaid GST customs and excise duties. In cash up to three-hundred Malaysian Ringgit MYR300.

Visit your Customs office in person to follow up.

. Conditions For Refund Of GST Under Tourist Refund Scheme. GST is charged on all taxable supplies of. Intended date of departure from Malaysia.

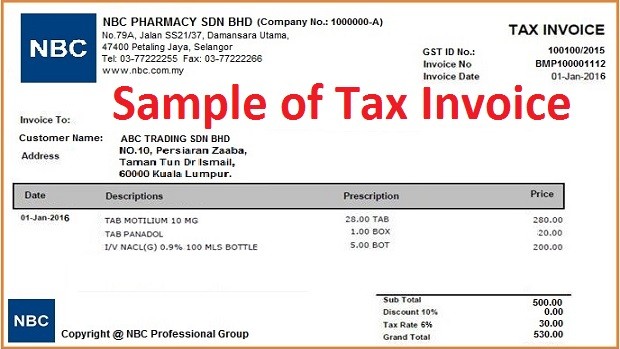

Claiming GST Refunds. The refund form should contain the following particulars. You must be a registered person thats taxable person.

One of them is GST refunds. Input tax credit is introduced to help to eliminate the cost cascading effect of the pre-GST tax regime. Refund will be made to the claimant within 14 working days if the claim is submitted online or 28 working days if the claim is submitted manually.

Depending on the refund method it can be paid out in cash up to 300 MYR300. The tourist must indicate in the appropriate column on the original refund form on how the refund is to be made. Claiming your GST Refund Malaysia is not difficult but you need to know what to do before you make your purchases to ensure that you have your tax invoice from an approved sales outlet.

GST had been revoked with effect from 31 August 2019. Minister Tengku Datuk Seri Zafrul Abdul Aziz said the payment. Directly follow up with the Customs officer to check on the refund status 1.

As a tourist visiting Malaysia how to claim a refund of GST paid on eligible goods purchased from an Approved Outlet. As a tourist visiting Malaysia how to claim a refund of GST paid on eligible goods purchased from an Approved Outlet As a business the conditions and eligibility requirements to become an Approved Outlet 2. A tourist shall be entitled to the refund of GST under the TRS if she satisfies the following conditions.

Goods Services Tax in Malaysia. It applies only to the tax paid on goods your purchases at shopping outlets not the GST on food accommodation etc. Overview of Goods and Services Tax GST GST is a multi-stage tax on domestic consumption.

For companies which qualify GST may be refunded first pending audit to be conducted. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana. In essence the final GST quantum is borne by the consumer versus the SST in which the.

Description and quantity of the eligible. Date of purchase of the eligible goods. On 15 June 2020 the Ministry of Finance announced that the Royal Malaysian Customs Department RMCD is committed to expedite GST refunds with payments expected to be made from 22 June 2020 and targeted to be completed by December 2020.

The High Court ruled that customs had erroneously rejected the taxpayers claim for an ITC refund. The refund can be made. Overview of Goods and Services Tax GST GST is a multi-stage tax on domestic consumption.

Many of the above often occur in companies which do not have a designated tax team or structure to manage tax matters or communication from authorities. Tourists can claim this 6 tax under certain conditions. He said the Royal Malaysian Customs Department RMCD will employ pay first and audit later.

KUALA LUMPUR June 15 The Finance Ministry through the Royal Malaysian Customs Department is committed to ensuring that the Goods and Services Tax GST refund to taxpayers will be expedited and payment to be made beginning June 22. To a credit card account. A recent decision by Malaysias High Court in LDMSB vKetua Pengarah Kastam Anor 17 June 2021 unreported as yet allowed the taxpayer LDMSB a refund of an input tax credit ITC in relation to the former goods and services tax GST as a refund of tax overpaid or erroneously paid The High Court decision is potentially controversial as claiming an ITC.

How Much Is GST Refund In Malaysia. The customs argument was that the GST Repeal Act 2018 stipulates that ITC refund must be made within 120 days from the appointed date and thus the taxpayer was out of time. The goods or services must have been acquired in the course or furtherance of the business means for business purposesITC is claimable on acquisition of capital assets used in the business such as equipment furniture etc.

The taxpayer was awarded the ITC refund with 8 interest running from. By credit card account. Below are the most important points to keep in mind when claiming GST in.

GST is charged on all taxable supplies of. Malaysia offers the Tax Refund Scheme which permits tourists to claim GST back on eligible goods purchased from an Approved Outlet. Through a bank cheque if neither of the previous refund options is feasible.

JUNE 28 The recent announcement made by the Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz that the Government will expedite the Goods and Services Tax GST refund to ease the cash flows of businesses during this trying time is applauded. In that case the tourist can claim a GST refund from an. Tax invoice or receipt number for the eligible goods.

Date of arrival in Malaysia. Tourists country of residence. She is neither a citizen nor a permanent resident of Malaysia not less than eighteen years of age and holds a valid international passport.

Claiming GST Refunds. As a business the conditions and eligibility requirements to become an Approved Outlet. However legacy issues still remain.

Criteria To Claim Input Tax Credit ITC Compliance Status. GST refunds may be owing to your company due to input tax not refunded by the Customs or due to GST overpaid by your company in the past. Any refund of tax may be offset against other unpaid GST customs and excise duties.

2 days agoDespite that the total amount of tax paid under GST is actually lower due to its input tax claim mechanism. In other words there is no cost cascading effect under the regime of GST because most of the taxes are combined into a single tax. Since April 1st 2015 Goods Services Tax has replaced Sales and Services Tax in Malaysia.

Refund will be made to the claimant within 14 working days if the claim is submitted online or 28 working days if the claim is submitted manually. The term Input Tax Credit ITC is one of the features or mechanisms of Goods and Services Tax GST. Overview of Goods and Services Tax GST GST is a multi-stage tax on domestic consumption.

The Ministry of Finance in June 2020 announced that the Royal Malaysian Customs Department is committed to expediting goods and services tax GST refunds with payments expected to be made from 22 June 2020 and targeted to be completed by December 2020. For pending GST refunds we can follow-up with the Customs authorities to obtain such. As a tourist visiting Malaysia how to claim a refund of GST paid on eligible goods purchased from an Approved Outlet As a business the conditions and eligibility requirements to become an Approved Outlet.

Gst How To Record Payment Made Or Received For Gst Treezsoft Blog

How To Start Gst Get Your Company Ready With Gst

Gstr 11 Pdf Gstr 11 Form Tax Refund Goods And Services Patent Registration

Around The World In 46 Carbon Markets Paris Climate Climates Climate Action

Guide To Tax Refund In Malaysia Bragmybag

Gst Guidelines On Tourist Refund Scheme Klia2 Info

What Is Gst And How Does It Work Infographic Xero Sg

All About Gst Returns For E Commerce Operator And Sellers Ebizfiling

What Is Gst Goods And Services Tax Or Gst Is A Consumption Tax Based On Value Added Concept Unlike The Present Sales Tax Or Service Tax Which Is A Single Stage Tax Gst Is A Multi Stage Tax Payment Of Tax Is Made In Stages By Intermediaries In The

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

What Is Gst Goods And Services Tax Or Gst Is A Consumption Tax Based On Value Added Concept Unlike The Present Sales Tax Or Service Tax Which Is A Single Stage Tax Gst Is A Multi Stage Tax Payment Of Tax Is Made In Stages By Intermediaries In The

What Is Input Tax Credit In Gst How To Get Gst Refund Goods Services Tax Gst Malaysia Nbc Group

A Complete Guide On Gst Returns On Exports Refund Process

.jpg)